Why We Invested In ResilienceVC

By Nicolle Richards, former Senior Investment Manager, and Catherine Toner, Managing Director of Impact Investing

At Gary Community Ventures, we invest in fund managers and entrepreneurs with innovations positioned to scale in the areas we care most about: Family Economic Mobility, School Readiness and Youth Success. Our approach is to invest early and establish strong relationships with managers and portfolio companies to create foundations for trust and impact, with the ultimate goal of improving lives of Colorado kids and families.

In our family economic mobility outcome work, we’ve put an emphasis on funding and scaling strategies that stand to change families’ financial health–by increasing income, decreasing expenses, and building wealth. On the impact investing side, this means approaching a family’s income statement and balance sheet in the same way an investor would a company’s financial statements. Within a family’s income statement, in order to support economic mobility, we need to invest in strategies that increase a family’s income, decrease their expenses, and ultimately retain those savings longer-term. Those savings are an important contribution to the family’s balance sheet, but in order to build wealth, families need access to mechanisms that build their assets, reduce liabilities, and increase equity.

We invested in ResilienceVC because their strategy aims to support all of these levers to build wealth and … resilience.

We were especially excited about ResilienceVC because of our shared view of what it takes to put families on a pathway to economic mobility. ResilienceVC sees the crisis of increasing financial vulnerability among Amercians as an unserved market and therefore a market opportunity where embedded fintech models can create access to financial services that help increase income, cut costs, mitigate risks, and build wealth. Within this broader thesis, ResilienceVC focuses on financial challenges, such as massive consumer debt, and financial opportunities, such as “found money”, where embedded fintech models can deliver customer value to low-income consumers with unit economics that work. By focusing on seed-stage startups, they are able to partner with entrepreneurs at the exact moment they are proving out their product-market fit, ensuring impact alignment in the core business model itself.

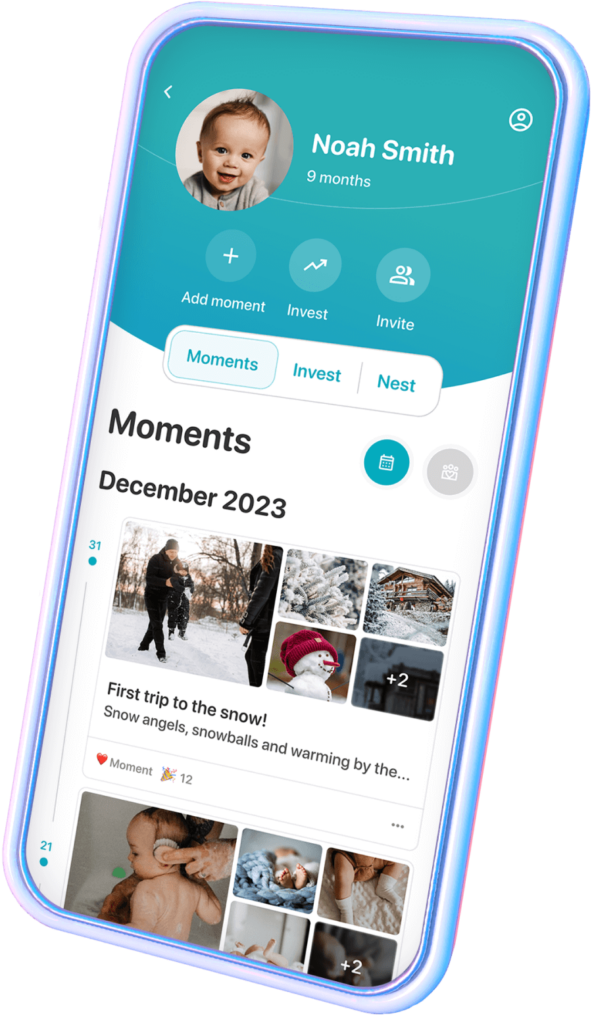

One of Resilience’s first investments was in EarlyBird, a company making early investing accessible to more families and their kids. By investing in EarlyBird, Resilience aims to help low- and moderate income (LMI) Americans take advantage of 18+ years of compounding growth in public equities, meaningfully building a child’s balance sheet and increasing financial stability and resilience from early adulthood.

Consistent with our strategy, we connected with EarlyBird soon after investing in Resilience and have built strong relationships with their founders, who are passionate about scaling their product to support LMI families. We are currently working to bring the product’s impact to families in Colorado, by designing a pilot to bring the company’s custodial investment account product to LMI kids and fund those accounts to build wealth to an extent that would give them net worth from birth. We see this pilot as complementary to nationwide efforts around baby bonds and policies that support their uptake. We are excited to continue to work with our community to design, implement, and measure the impact of this pilot. Our aim is to add this pilot to the existing body of work demonstrating the power that wealth-building tools have in supporting family economic mobility, and are also eager to collaborate with local partners in these efforts.

Share this post

Related Articles

New Fund Launches to Increase Rural Child Care Capacity

A new fund will offer below-market rate loans to help increase physical capacity for child care across rural Colorado.

Why We Invested: Kah Capital Management

Rather than treating all past due borrowers the same, Kah recognizes that temporary hardship can be resolved with the right support.

Introducing Gary’s Approach to Sunset

By 2035, all the assets of Gary Community Ventures will have been transitioned from our balance sheet to the community.

COinvest: Place-Based Investing in Colorado

COinvest demonstrates how place-based investing can unlock both financial returns and lasting community impact, reimagining the future of philanthropy in our own backyards.