Building Generational Wealth Through Homeownership

What Could Be

Families pass down wealth from one generation to another

Should Be

Provide down payment assistance to first-time homebuyers who have faced systemic barriers to homeownership

Homeownership is one of the most accessible pathways to building wealth in the U.S., yet systemic barriers have long locked many American families out of this opportunity, contributing to a growing wealth gap.

To tackle this inequity, Gary designed and is incubating the Dearfield Fund, a first-of-its-kind private equity impact fund that provides up to $40,000 in down-payment assistance to first-time homeowners who have faced systemic barriers to homeownership.

The down-payment assistance is a loan, but homeowners do not make monthly payments and pay no interest. Instead, when homeowners sell or refinance, they repay the initial down-payment loan amount plus 5% of their home’s appreciated value. This model creates a small, below-market-rate return for the investors who funded the down-payment assistance.

Since launching in 2021, the Dearfield Fund has raised more than $14 million in private capital and distributed $9 million in down-payment assistance. As of the fall of 2025, more than 230 Denver-area families are in their first home and on the road to building generational wealth. Additionally, the Dearfield Fund’s impact is more than financial. Families report greater security, confidence and optimism for the future. As a Gary venture, the Dearfield Fund is currently incubated at Gary and has expanded its services to include wraparound support services and learning opportunities. The innovative shared appreciation financial model has been replicated in other housing programs, including Colorado’s own Senate Bill 25-167, which created a down-payment assistance fund for public school employees during the 2025 legislative session.

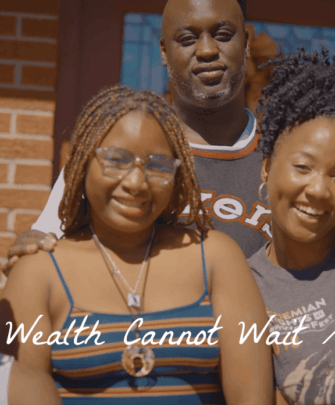

“I know my grandmother worked hard so that my mom would have it a little bit easier. My mom worked hard so that I would have it a little bit easier. And now I’m working so my kids have it a little bit easier. It really starts with us right now.”

Neecie MaybinDearfield Fund Homeowner

What Makes The Dearfield Model Different

In addition to centering social equity, the Dearfield Fund has a unique impact-first financial structure that, when compared to other down-payment assistance programs, favors homeowners more than investors.

1

Private Equity Fund Model

The Dearfield Fund isn’t a loan or grant program — it’s an investor-facing private equity fund, giving investors a stake in both the risks and rewards, directly aligned with homeowners’ wealth creation.

2

Shared Appreciation Mechanism

The fund receives just 5% of the appreciated value when a homeowner sells or refinances. This equity share creates a non-extractive way to support wealth building, as homeowners retain the overwhelming majority of the value gained.

3

Community Second Mortgage Structure

Instead of grants or conventional loans, the fund uses a community second mortgage — an innovative tool that helps buyers access homeownership while maximizing impact and creating a sustainable investment model.

4

Scalable & Sustainable Impact

By moving away from one-time grants and designing an investment vehicle that generates returns through modest appreciation sharing, the fund creates a recyclable, long-term capital structure. This sustainability ensures that the program can expand its reach and continue addressing the wealth gap for generations.

Innovative Financing MEETS Affordable Housing

How We Build Wealth

Black Wealth Cannot Wait

In 4 years, The Dearfield Fund has helped first-time Black homebuyers close on more than 230 homes in Colorado.

The Creation Of Home: The Williams Family

Their landlord gave them 90 days to vacate. Weeks later, with the help of a new fund, they were homeowners.

The Creation Of Home: The Johnson Family

Dearfield sees the potential in Black women like Nicole, the fastest-growing group of entrepreneurs in the U.S.

Our work to

Build fAMILY Wealth

Because building wealth across a household balance sheet requires more than one approach, we invest in opportunities that expand access to homeownership, employee ownership, shared real estate and financial accounts that grow in value over time.