April 4, 2024

HB-1311 Cuts Child Poverty in Half, Benefits 45% of Colorado Families

House Bill 24-1311, also known as the Family Affordability Tax Credit, is begin considered by Colorado lawmakers in the 2024 legislative session.

By Reilly Pharo Carter, Director of Policy & Advocacy

At Gary, we’ve always believed that business, policy and philanthropy can and should work together to improve outcomes for Colorado kids and families. Through our policy arm, Gary Advocacy, we work to advance transformative policies, invest in a thriving policy ecosystem and support ongoing improvement of public systems in order to create scalable, long-lasting impact at the state and local level.

With Colorado’s 2024 legislative session just past the halfway mark, we wanted to provide an update on a key bill we’re supporting this legislative cycle, which is House Bill 24-1311, also known as the Family Affordability Tax Credit.

At the most basic level, this bill — along will every bill we’re supporting this legislative session — will make Colorado a more affordable and equitable place to raise children, where families have a better chance at being successful as a result of the policies our state enacts.

Why is this the approach we’re currently championing? Because…

Cost of living is the No. 1 issue reported by Colorado families

We now know families need to make at least six figures to afford a median priced home in our state, the poverty rate is more than twice the national average in many Colorado communities, and as a result, more than 133,000 of our state’s children are living in poverty.

As a community, we cannot accept this, and together this legislative session, we can provide hope and better outcomes to our kids and families.

You can learn more about this bill below. Interested in joining the coalition supporting it? Let us know here.

Why Should Legislators Vote Yes on HB-1311?

At a time when Colorado has become unaffordable for most families, HB-1311 harnesses a portion of our $1.8B in TABOR surplus — projected to grow in future years — to cut child poverty in half and put more money in the hands of 45% of Colorado families, including those making up to $95K a year.

What Does HB-1311 Do?

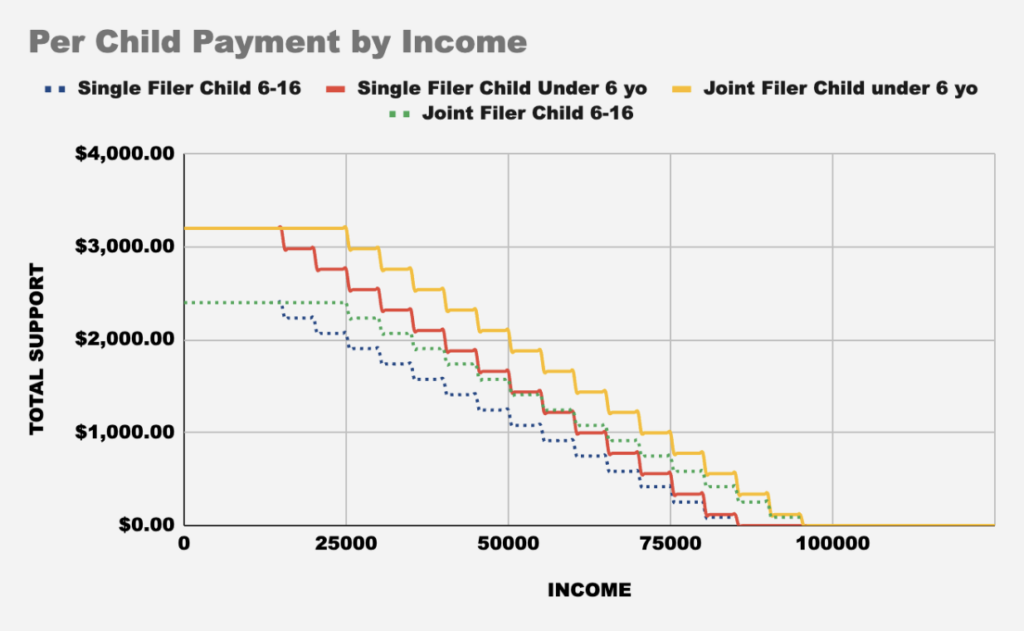

Families with kids 5 & under who get the Child Tax Credit & Family Affordability Tax Credit will receive $4,400 per child. And for the first time, Families with kids up to 16 making under $15K (single filer) & 25K (joint filer) will receive $2,400 per child. Families making up to $95K would also benefit on a sliding scale.

Who Does HB-1311 Benefit?

- 400,000 Colorado kids will benefit from HB-1311

- We’ll see a 50% reduction in the rate of children experiencing child poverty, which we know is currently impacting more than 133,000 Colorado kids

- 45% of all Colorado families will benefit from HB-1311 on a sliding scale based on their income, which is outlined below.

Why is HB-1311 Needed Now?

Rising Costs is the No. 1 Issue Colorado families face: This is according to the Colorado Health Foundation’s annual survey, which found Coloradans reporting affordability being the top issue in the state.

Family tax credits are proven and popular: Extensive research, including a 2022 report from the Institute on Taxation and Economic Policy(ITEP), has shown refundable tax credits are effective in helping families meet essential needs, create greater stability and move out of poverty. The Economic Security Project also found refundable tax credits have significant bipartisan support, as they provide families autonomy to address a variety of rising costs.

Child poverty desperately needs to be addressed, and Colorado could become a leader in doing so: HB-1311 would cut Colorado’s child poverty rate in half, according to the same ITEP report. This would result in our child poverty rate becoming the third-lowest in the U.S.,signaling to the nation that Colorado is a great place to raise kids and an exemplary model for other states to follow.

We are in need of prudent usage of TABOR refunds, which are under threat from the IRS: TABOR refunds won’t be taxed this year, but the IRS has made it clear they intend to make flat-tax refunds taxable income, meaning Colorado could lose as much as one-third of our TABOR surplus to federal taxes. We can make a change to preserve more of those funds for Coloradans now.

Who Supports HB-1311

We’re proud to have a broad coalition standing with Gary Advocacy in support of this bill, which includes the following members. You can join us here.

- ActivateWork

- Bell Policy Center

- Caring for Colorado Foundation

- Colorado Access

- Colorado Black Women for Political Action

- Colorado Association of Family & Children’s Agencies

- Colorado Coalition for the Homeless

- Colorado Children’s Campaign

- Colorado Fiscal Institute

- Colorado Home Visiting Coalition

- Colorado Statewide Parent Coalition

- Community Economic Defense Project

- Community Investment Alliance

- Council for a Strong America

- Dream Centers

- Early Childhood Partnership of Adams County

- Early Learning Ventures

- Efshar Project

- FaithBridge

- Feeding Colorado

- Fostering Colorado

- Gary Advocacy

- Healthy Child Care Colorado

- Healthier Colorado

- Hunger Free Colorado

- Illuminate Colorado

- Lakewood United Methodist Church

- Maiker Housing Partners

- Mental Health Colorado

- Parent Possible

- ProsperBridge PBC

- Rocky Mountain MicroFinance Institute

- Servicios de La Raza

- SIS

- Social Impact Solutions

- Spring Institute for Intercultural Learning

- Stand for Children Colorado

- TorchTech

- WellPower

- Women’s Foundation of Colorado