May 7, 2024

Why We Invested in ResilienceVC

By Catherine Toner & Nicolle Richards

Nicolle Richards is a former Senior Investment Manager at Gary

Why We Invested is a series from the Gary Community Ventures Impact Investing team highlighting recent investments and our investment philosophy. The goal of this series is to share our due diligence in service of empowering other impact investors and foundations to continue to leverage their full corpus for mission aligned investments. If you have any additional wonderings or recommended opportunities based on what you see here, please reach out.

At Gary Community Ventures, we invest in fund managers and entrepreneurs with innovations positioned to scale in the areas we care most about: Family Economic Mobility, School Readiness and Youth Success. Our approach is to invest early and establish strong relationships with managers and portfolio companies to create foundations for trust and impact, with the ultimate goal of improving lives of Colorado kids and families.

Within our Family Economic Mobility outcome area, we’ve put an emphasis on funding and scaling strategies that stand to change families’ financial health–by increasing income, decreasing expenses, and building wealth. On the impact investing side, this means approaching a family’s income statement and balance sheet in the same way an investor would a company’s financial statements. Within a family’s income statement, in order to support economic mobility, we need to invest in strategies that increase a family’s income, decrease their expenses, and ultimately retain those savings longer-term. Those savings are an important contribution to the family’s balance sheet, but in order to build wealth, families need access to mechanisms that build their assets, reduce liabilities, and increase equity.

We invested in ResilienceVC because their strategy aims to support all of these levers to build wealth and…resilience.

We were especially excited about ResilienceVC because of our shared view of what it takes to put families on a pathway to economic mobility. ResilienceVC sees the crisis of increasing financial vulnerability among Amercians as an unserved market and therefore a market opportunity where embedded fintech models can create access to financial services that help increase income, cut costs, mitigate risks, and build wealth. Within this broader thesis, ResilienceVC focuses on financial challenges, such as massive consumer debt, and financial opportunities, such as “found money”, where embedded fintech models can deliver customer value to low-income consumers with unit economics that work. By focusing on seed-stage startups, they are able to partner with entrepreneurs at the exact moment they are proving out their product-market fit, ensuring impact alignment in the core business model itself.

“ResilienceVC sees the crisis of increasing financial vulnerability among Americans as an unserved market & therefore a market opportunity where embedded fintech models can create access to financial services that help increase income, cut costs, mitigate risks, and build wealth.”

– Catherine Toner & Nicolle Richards

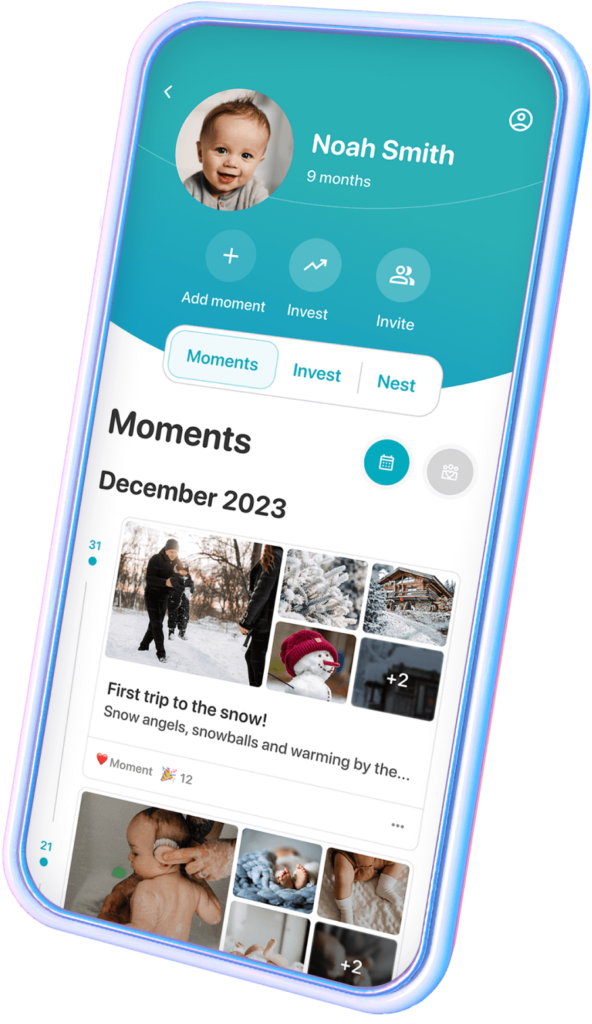

One of Resilience’s first investments was in EarlyBird, a company making early investing accessible to more families and their kids. By investing in EarlyBird, Resilience aims to help low- and moderate income (LMI) Americans take advantage of 18+ years of compounding growth in public equities, meaningfully building a child’s balance sheet and increasing financial stability and resilience from early adulthood.

Consistent with our strategy, we connected with EarlyBird soon after investing in Resilience and have built strong relationships with their founders, who are passionate about scaling their product to support LMI families. We are currently working to bring the product’s impact to families in Colorado, by designing a pilot to bring the company’s custodial investment account product to LMI kids and fund those accounts to build wealth to an extent that would give them net worth from birth. We see this pilot as complementary to nationwide efforts around baby bonds and policies that support their uptake. We are excited to continue to work with our community to design, implement, and measure the impact of this pilot. Our aim is to add this pilot to the existing body of work demonstrating the power that wealth-building tools have in supporting family economic mobility, and are also eager to collaborate with local partners in these efforts.

Are you interested in ResilienceVC, Early Bird, or our economic mobility approach at Gary? Send us a note.

MANAGING DIRECTOR, IMPACT INVESTING AT GARY COMMUNITY VENTURES

CATHERINE TONER

Catherine is Director of Impact Investing at Gary Community Ventures, where she leads investing and product structuring for the organization’s family economic mobility outcome area. She has a particular focus on housing finance, community and employee ownership, and the future of work. She has a passion for creating innovative investment structures that produce sustainable and scalable impact.

At Gary, that work has included structuring of The Dearfield Fund for Black Wealth, a fund launched by Gary to close the racial wealth gap by increasing Black families’ access to homeownership in Denver, and conceptualizing the tenant equity structure and helping to design the financing strategy for Proposition 123, the first successful ballot measure in the U.S. to create a statewide solution to the affordable housing crisis.

FORMER SENIOR INVESTMENT MANAGER AT GARY COMMUNITY VENTURES

NICOLLE RICHARDS

Nicolle is a former Senior Investment Manager at Gary Community Ventures, which leads fund and direct investments across Gary’s outcome areas with a particular focus on fintech, private credit, home ownership and employee ownership. Prior to Gary, Nicolle spent three years leading capital raising and investor relations work in Nairobi, Kenya with Lendable, a private credit investment firm that provides debt capital to fintech companies in emerging markets. She began her career working on social enterprise investments at the Draper Richards Kaplan Foundation.

As a young person with class privilege, Nicolle has also organized as a chapter leader with Resource Generation, a multiracial membership community of young people with wealth and/or class privilege committed to the equitable distribution of wealth, land and power.

Related Content

- Introducing Gary’s Approach to Sunset

- DPS Foundation Takes the Lead on My Spark Denver to Expand Access to Youth Enrichment Programs

- Impermanence Is The Future: Four Unsolicited Ideas For Sunsetting the Gates Foundation

- When We Gather: Relationships, Innovation and Harmony

- MyFriendBen Expands to Pueblo County