WEALTH

through ownership

The opportunity to own an asset that grows in value is the most proven pathway to build wealth. For too long, families of color have seen this pathway blocked. We’re now actively partnering with our community to build an ownership movement capable of closing our racial wealth gap in new, bold and innovative ways. Join us.

Why Ownership?

The roots of wealth creation in this country come from owning assets — land, houses and businesses

More than ever, the tremendous wealth generated by the richest country in the world is concentrated in the hands of fewer and fewer people. When you consider persistent gaps in household wealth across different communities, we’re facing a serious challenge with wide-reaching consequences—one that affects economic stability, social cohesion, and the strength of our country as a whole.

We see an opportunity to build a different path.

Despite efforts to ensure greater opportunity, there are countless examples, through history and into current times, where policies have prevented some communities from owning assets both directly and indirectly. Attempts to rectify those policies — redlining, predatory lending, discriminatory housing practices like devaluing homes in Black neighborhoods — have been slow at best and ineffective at worst.

The philanthropic sector, impact investors, and policymakers have an opportunity to drive meaningful change through a simple strategy—expanding access to asset ownership and wealth-building opportunities for those historically excluded from them.

Doing so can help narrow persistent wealth gaps and strengthen economic mobility for all.

How Wide is the Country’s Wealth Gap?

Across Colorado and beyond, communities experiencing significant disparities have disproportionately been denied access to ownership pathways.

(Chart Source: Bell Policy Center)

- Homeownership

- Colorado homeownership rates are twice as high for white households compared to Black households — and that gap is widening.

- Business Ownership

- According to the Center for Financial Household Stability at the Federal Reserve Board of St. Louis, white and Asian Americans hold one third of their assets in business and financial sectors. Latinos and African Americans hold only 15% and 8%, respectively, of their wealth in the form of business ownership.

- Individual Savings & Assets

- Nationally, as of 2022, 62% of Black and 69% of Latino workers had $0 in retirement assets, and those numbers are similar in Colorado.

- Community Ownership

- Denver saw more gentrification than any other U.S. metro area except San Francisco between 2013 and 2017. People of color make up 77% of the population in gentrifying neighborhoods. The influx of new money in these communities cuts back on affordable housing and community resources, leading to displacement of residents with low- and moderate-income, the National Community Reinvestment Coalition researchers wrote.

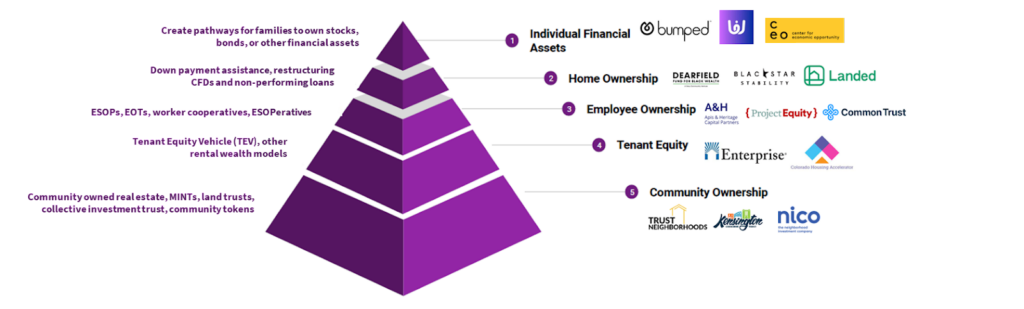

The Ownership Pyramid

Though this work is nascent, we believe we’re on the cusp of catalyzing an ownership movement

Foundations and philanthropic institutions including the likes of Gary Community Ventures and national partners likeWorld Education Services (WES) are at the forefront of supporting innovative capital tools. We have developed a framework that can serve as a compass for other foundations and investors to invest with an ownership lens.

The underlying theses behind this ownership strategy are as follows:

- All families should have the opportunity to build assets that can grow in value over time. This often, though not always, includes owning some form of appreciable assets. This often, but not always, means owning some form of appreciable assets.

- We need models that are not dependent on forcing families to save based on their income. We are excited for passive wealth-generating strategies, whereby low and middle-income families can build wealth by living in a home, working in a job, or even by being a renter.

- These new models create accessible opportunities for underinvested in and overlooked communities to begin to build wealth at scale.

With these premises in mind, our framework describes a range of models and innovative approaches to build pathways for ownership, wealth creation, and power- building for underinvested in and overlooked households and communities.

The ownership pyramid can be further unpacked to lay out specific strategies and examples that we’ve invested in under each category:

- Individual Financial Assets: This category is well recognized. This includes expanding individuals’ access to stocks, bonds and other financial assets.

- Home Ownership: Increased access to home ownership among lower- and middle- income families of color can have a dramatic impact in bridging the racial wealth gap.

- Employee Ownership: The majority of the low- and middle- income workforce in the U.S. is employed at small and medium businesses and there is a huge untapped opportunity to unlock employee ownership in these businesses.

- Tenant Equity and Renter Wealth: We are seeing the emergence of innovative approaches that offer renters a share of upside in multi-family properties where they rent. We call these approaches tenant equity. Given the growth of multi-family rental housing as a common asset class in the balance sheets of impact investors, we feel there is a tremendous opportunity to share some of this upside with renters.

- Community Ownership: At the bleeding-edge of solutions are approaches where we start sharing a share of prosperity and wealth generated in the entire neighborhood with people who live there and are key to the economic fabric of that community. Models that bolster community ownership include approaches like neighborhood real estate investment trusts and community investment trusts.

Emerging Solutions

The promising list of investable opportunities continues to grow

Dearfield Fund: Unapologetically for Black Homeowners

Ownership Vehicle: Homeownership

Aisha T. Weeks is leading the The Dearfield Fund,a concessionary private equity fund which provides up to $40,000 in down-payment assistance to first-time homebuyers to help build generational wealth. The down-payment assistance is like a loan, but homeowners don’t make monthly payments and pay no interest. Instead, when homeowners sell or refinance they repay the down-payment amount plus 5% of their home’s appreciation, which allows the Dearfield Fund to serve more homeowners.

Apis & Heritage Capital Partners: ESOPs for Workforces of Color

Ownership Vehicle: Business Ownership

Partner Phillip Reeves is helping implement Apis & Heritage’s Employee-led Buyout (ELBO©) approach, which provides:

- Workers in essential industries with the most powerful wealth building tool in our nation – equity in a thriving business

- Companies with the incentives and support to grow and the capital needed to build balance sheets for long-term resilience

- Founders with capital to support ownership transitions that preserve their legacies and meet their retirement needs

- Communities with stable jobs and business continuity

- Investors with timely exits, competitive returns, and clear and measurable impact

The Savings Collaborative: Providing Fair Access to Savings & Assets

Ownership Vehicle: Individual Financial Assets

The Savings Collaborative provides tools to help families start saving and creating the future they want in just 2 minutes with only $5. This nonprofit provides easy-to-use digital savings tools, personalized savings coaching as well as safe and low-cost microloans for emergencies to help users save money and build a lifetime habit of savings. They lean into a high-tech, high-touch approach that aims to utilize:

- Technology: An easy-to-use, multilingual savings club app powers the savings club, with built-in prompts to encourage and celebrate savers.

- Community: Local ambassadors are the heart of the savings club. They build trusted relationships with members and provide personalized savings coaching and support.

- Education: Learning-by-doing is key to lasting change. Save as you develop financial skills using our interactive digital tools and workshops.

Additional Solutions

You can find a full, consistently update list of emerging ownership solutions here at Impact Alpha. Some highlighted solutions are below.

Woveo

Ownership Vehicle: Individual Financial Assets

Savings groups are an alternative to credit and gives you flexibility to access and build credit on your own terms

Kensington Corridor Trust

Ownership Vehicle: Community Ownership

Kensington leverages a neighborhood trust model to maintain local control of property use & values

Colorado Housing Accelerator Initiative

Ownership Vehicle: Tenant Equity

CHAI’s tenant equity vehicle is a path-breaking model that has never been attempted at this scale

Bumped

Ownership Vehicle: Individual Financial Assets

Bumped’s technology gives consumers the power to turn their everyday spending into free stock ownership

Center for Economic Opportunity

Ownership Vehicle: Individual Financial Assets

CEO is designed to offer modest loans — primarily to low-income refugee and immigrant borrowers — at affordable rates from trusted locations

Black Star Stability

Ownership Vehicle: Homeownership

Blackstar Stability provides investors with risk-adjusted returns while generating significant benefits for low- and moderate-income families through restructured distressed mortgages and land sale contracts

Dearfield Fund for Black Wealth

Ownership Vehicle: Homeownership

Dearfield provides up to $40K in down-payment assistance to first-time homebuyers in communities that have historically been denied access to open up new paths to wealth.

Apis & Heritage Capital Partners

Ownership Vehicle: Employee Ownership

A&H combines the speed, scale and expertise of private equity with the proven productivity and wealth building power of employee ownership

Enterprise Community Partners

Ownership Vehicle: Homeownership

Enterprise supports community development organizations, makes housing-based impact investments, advances housing policy while building and managing communities themselves

Have a solution or learning we should add to this movement? Email us at communications@garycommunity.org

Keep in Touch

Venture with Us

Together, we will create the change our community wants to see. Whether you want to discover more about our ventures, or connect with a member of our team, we want to hear from you.